In 2024, global cryptocurrency activity continues to grow, with developing economies leading in cryptocurrency ownership.

Adoption of the new asset class is increasing around the world, thanks in part to the launch of Bitcoin and Ether exchange-traded funds (ETFs) in the United States, which has boosted its adoption, particularly in institutional transfers and higher income regions.

However, regulatory concerns remain a major hurdle, particularly in the US and UK, although Europe is taking steps to address these challenges with Regulation of Markets in Crypto Assets (MiCA).

Global crypto activity on the rise

Global crypto activity has continued to increase this year despite market volatility. Between Q4 2023 and Q1 2024, the total value of global crypto activity increased significantly, reaching higher levels than 2021 during the crypto bull market, according to data from Chainalysis. to show.

The report states that while growth in crypto adoption was primarily driven by lower-middle-income countries in 2023, this year saw growth in countries of all income levels, supported by positive developments.

The findings from Chainalysis echo those of new research from Triple A Technologies. According to According to the “State of Cryptocurrency Ownership Worldwide in 2024” report, the global digital currency user base reached 562 million people this year, an increase of 34% from 420 million in 2023. This figure suggests that 6 .8% of the world’s population are now crypto owners, with crypto ownership growing by a compound annual growth rate (CAGR) of 99% between 2018 and 2023.

Central and South Asia and Oceania Dominate Crypto Adoption

This year, adoption of cryptocurrencies was strongest in Central and South Asia, as well as Oceania (SWAC). The region dominates Chainalysis’s “2024 Global Crypto Adoption Index,” with seven of the top 20 countries located in the CSAO. These countries are India (No. 1), Indonesia (No. 3), Vietnam (No. 5), Philippines (No. 8), Pakistan (No. 9), Thailand (No. 16) and Cambodia (No. 17), all of which demonstrated strong activity in both cryptocurrency trading and decentralized finance (DeFi) between 2023 and 2024.

The Global Crypto Adoption Index is based on four sub-indexes, each measuring different aspects of cryptocurrency usage. It ranks a total of 151 countries based on factors such as transaction volume, population size and purchasing power.

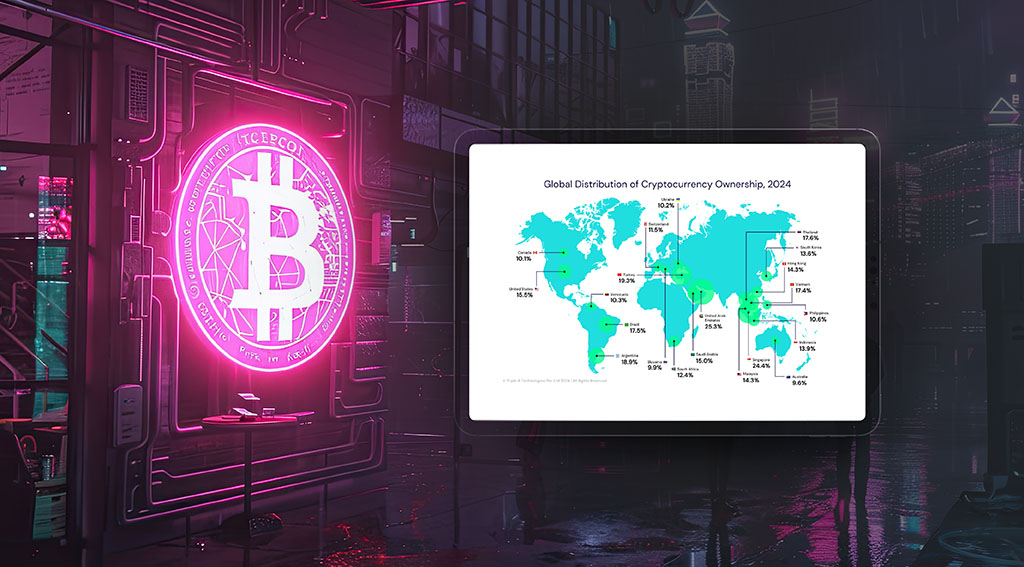

Developing Economies Dominate Cryptocurrency Ownership

Developing economies currently lead in crypto adoption, United Arab Emirates (UAE), Singapore (24.4%), Turkey (19.3%), Argentina (18.9%) , with Thailand (17.6%) and Brazil (17.5%) showing high levels. crypto ownership, according to to the 2024 Gemini “Global State of Crypto” report.

The high penetration of cryptocurrencies in developing economies is often due to limited access to traditional banking services, high remittance costs, inflation and currency instability. These digital assets offer an attractive alternative for saving, transferring money and accessing financial services, especially in regions where financial infrastructure is weak. Additionally, the younger, tech-savvy population of these countries is more open to adopting new digital solutions.

ETF brings growth through affordability

The launch of Bitcoin and Ether spot ETFs in the United States in January and July 2024, respectively, has been a major driver of increased crypto adoption this year. According to the Chainalysis report, the development marked a significant milestone for the entire crypto industry and spurred significant growth in crypto activity across all regions, particularly in institutional-sized transfers and in regions with higher incomes like North America and Western Europe.

In the United States, 37% of cryptocurrency owners surveyed by Gemini in 2024 reported holding a portion of their cryptocurrencies through an ETF, highlighting the role of these instruments in the growth of the sector. Notably, 13% of respondents said they own cryptocurrencies exclusively through an ETF, indicating that many investors entered the market through ETFs when they were introduced this year.

The introduction of spot Bitcoin ETFs earlier in 2024 has generated considerable enthusiasm. In the first month of trading, daily trading volume totaled nearly US$8 billion, an increase of 63.8% from the previous high of US$4.7 billion reached on January 11, 2024, first day of trading, and reflecting the strong interest of investors in this new market. asset class.

Investors remain bullish on crypto

This year, consumer attitudes towards crypto have remained positive among owners and former owners. According to the Gemini survey, 57% of current crypto owners feel comfortable making crypto a significant part of their investment portfolios. Additionally, 27% of former cryptocurrency owners expressed similar sentiments, indicating that many may re-enter the market.

Institutional investors are also showing growing interest in digital assets. An EY-Parthenon study find that 94% of 277 institutional investor decision-makers surveyed believe in the long-term value of blockchain and digital assets, and 79% consider them crucial for portfolio diversification.

Additionally, 38% of these respondents said they have already committed between 1% and 5% of their funds to digital assets or crypto-related investments, and in the case of family offices, almost half are in this allocation range. Traditional hedge funds pursue gains in digital assets even more aggressively than their peers, with 22% of them allocating more than 5% of funds.

Regulatory concerns as a barrier

Despite the increase in crypto activity and its growing adoption by retail and institutional investors, regulatory concerns remain a significant obstacle.

In 2024, a higher percentage of respondents in the US, UK and Singapore cited regulatory uncertainty as a major barrier to investing in cryptocurrencies compared to 2022, survey finds Gemini.

These results align with the findings of the EY-Parthenon survey which reveals that while half of companies are interested in investing in tokenized assets, 28% do not plan to invest until 2026 or later, and 30% are awaiting clarification regulations before moving. Before.

The European Union (EU) has taken a major step to address these concerns, approving in June 2023 the MiCA regulation. MiCA, set to be applicable From December 30, 2024, it will introduce uniform market rules for cryptoassets across the EU, providing a stronger and more transparent legal framework that should drive crypto adoption and investment. -currencies in Europe.

Featured image credit: edited from free pik