Tradingkey – The rise in the cryptocurrency market has changed the global financial landscape. It has aroused growing interest in the composition of market financing. Understanding this composition is crucial to assess market health, liquidity and potential future trends. This article analyzes the sources, distribution and impact of cryptography market funds aimed at helping investors and institutions better understand market dynamics.

The composition of cryptocurrency market financing refers to the global structure and the sources of capital on the cryptography market. By analyzing this composition, we can better understand the models of capital flows, the behavior of investors and key market health indicators which help predict the future market orientations.

The main sources of financing in the cryptography market are divided into four categories: retail investors, whales, minors and institutional investors. Each group has separate characteristics in terms of fund size, investment strategy and period of detention.

|

Source |

Description |

Features |

|

Retail investors |

Individual investors who form the market foundation. Their funding often reflects the feeling of the market. |

– Typical transactions are less than $ 10,000. – High trading frequency, average detention period in less than 1 month. – Sensitive to Fomo (fear of missing). |

|

Whales |

Individuals or institutions with large amounts of crypto. |

– larger investment scale, longer detention periods. – The first participants with low entry costs. |

|

Minors |

People who win crypto by maintaining blockchain networks and validating transactions. |

– Continuous financing, some used for market trade or daily expenses. |

|

Institutional investors |

Major capital of hedge funds, public enterprises and traditional financial institutions. |

– Large investments, generally more than a million dollars. – Average detention period of 6 to 12 months. – Use professional strategies such as quantitative trading and arbitration. |

|

Governments and public institutions |

Countries like the United States, China and Ukraine have Bitcoin. El Salvador invests in Bitcoin. |

– Low proportion of investment, but adds legitimacy to the market. – Most acquire by confiscation; Some explore CBDC. |

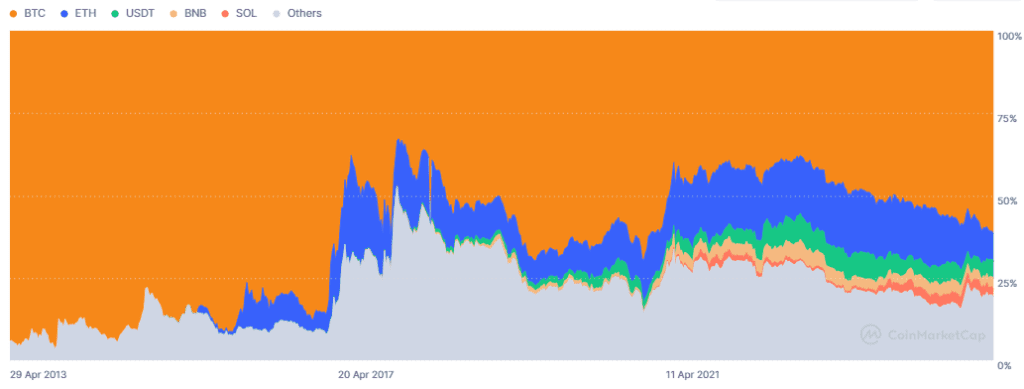

Once new funds are entering the cryptography market, they generally exist in four forms: Bitcoin, Ethereum, Stablecoins and Altcoins. Bitcoin attracts the most capital and often represents more than 50% of the total market share. Combined bitcoin (BTC) and Ethereum (Ethn) frequently represent more than 80% of the market.

Capitalization of stock markets of BTC, ETH and other cryptocurrencies, Source: Coinmarketcap.

Since the creation of the cryptocurrency, Bitcoin has always occupied first place in terms of market share. Ethereum maintains the second positionWith its market share generally fluctuating between 10% and 20%. However, Ethereum faces growing competition from other cryptocurrencies such as Ripple (Xrp) and Solana (GROUND).

The stablecoins, known for their relative stability of prices, serve as critical exchange of exchange in cryptographic trade. Currently, there are more than 200 stablecoins with a combined market capitalization of $ 230 billion – only a second for 1.6 billion of dollars of bitcoin.

Crypto funding exists mainly through bitcoin, ethereum, stablecoins and altcoins. Their stock market capitalizations fluctuate according to different market cycles.

In a bull market, liquidity is high. Funds generally enter the market through Stablecoins, increasing their total scale. However, this is often a transition phase, because investors end up converting stablecoins into assets such as BTC, ETH and Altcoins, which increases their prices and their overall market value. This model was particularly obvious in 2017, 2021, and was again expected in 2024.

Changes in the total market capitalization of cryptocurrencies, Source: Coinmarketcap.

In a lower market, capital leaves space, leading to a contraction of global market capitalization. This was remarkable in 2019 and 2022. Investors often pass volatile assets in the stablescoins as risk -to -study. Although the total market capitalization of stablecoins can decrease, their proportional domination can remain relatively stable.

As a rule, the share of Bitcoin decreases during the bull markets, while Ethereum and Altcoins increase. The reverse occurs on the bear markets. For example, during the Bull Run 2017, Ethereum’s market share peaks at 31%. On the other hand, the domination of Bitcoin fell to 38% during the 2018 transition to a lower market.

Bitcoin market share, Ethereum and other cryptocurrencies, Source: Coinmarketcap.

Understanding the capital flow on the cryptography market is crucial to predict price movements and stability. Key financing data include data on the chain, exchange data, institutional financing and DEFI financing flows. The monitoring of these requires different tools:

|

Data type |

Key indicators |

Main tools |

Application scenarios |

|

Chain data |

1. Net / exit exchange exchange 2. Whale transfers 3. Minors holding 4. Stablecoin deletion |

– glass node – cryptocurrency – Nansen – Whale alert |

– Evaluate market pressure – Monitor the activity of whales – Predict trend reversals |

|

Data exchange |

1. Exchange reserves 2. Open interest (OI) 3. Financing rate 4. Put / call ratio |

– Co -quince – Laevitas – Insibit Insights |

– Observe the lever effect of the market – GAUGE OPTIMISTME SENSE / DAYER – Predict short -term volatility |

|

Institutional financing |

1. Grayscale GBTC Holdings 2. General for public companies 3. Investment trends in VC |

– Bitcoin treasure – ycharts – Crunchbase |

– Follow the institutional fund flows – Position for potential investment opportunities |

|

DEFI funding |

1. Locked total value (TVL) 2. Cross -chain stable flows 3. Movements of intelligent contract funds |

– Defillama – Analytics of the dunes |

– Evaluate the heat of the DEFI market – Monitor the migration of the fund (for example, from CEX to DEFI) |

It’s essential to Use several data sources for cross validation. For example, if data on the chain show that whales accumulate while the feeling of the market remains frightening, this may indicate an opportunity to purchase. Combine financing data with technical analysis – as levels of support and resistance – can improve the success rate of trading strategies. In addition, be aware of the data lag, as measurements on the chain reflect past transactions. To obtain a more complete image, associate them with the dynamics of the market in real time and the indicators of feeling such as indications of fear and greed, social media trends and Google research volumes.

Understanding the composition of financing the cryptocurrency market is essential to discover the underlying market trends. The analysis of sources of financing, distribution and capital flows helps investors and institutions to develop more enlightened and effective strategies. Without this insight, investors are likely to sail blindly on the market – potentially leading to expensive errors.

As technological progress and institutional participation are developing, the cryptography financing ecosystem can evolve. However, its global structure is unlikely to undergo drastic changes, so there is no need for excessive concern.

Warning: for information only. Past performance is not indicative of future results.