A company listed in Japanese, Metaplanet, is preparing to launch privileged actions supported by Bitcoin. This new financial product could reshape the fixed income market in Japan.

Interest rates in Japan, remaining historically low, Metaplanet plans to offer titles labeled in Yen with high annual yields from 9 to 10%, using bitcoin as guarantee.

The problem on the Japan financial market

EXPERT IN CRYPTO Adam Livingston Explains that Japanese households hold more than 2,200 yen billions in financial assets. A large part of this money is in cash or deposits which earn less than 0.23% of interest.

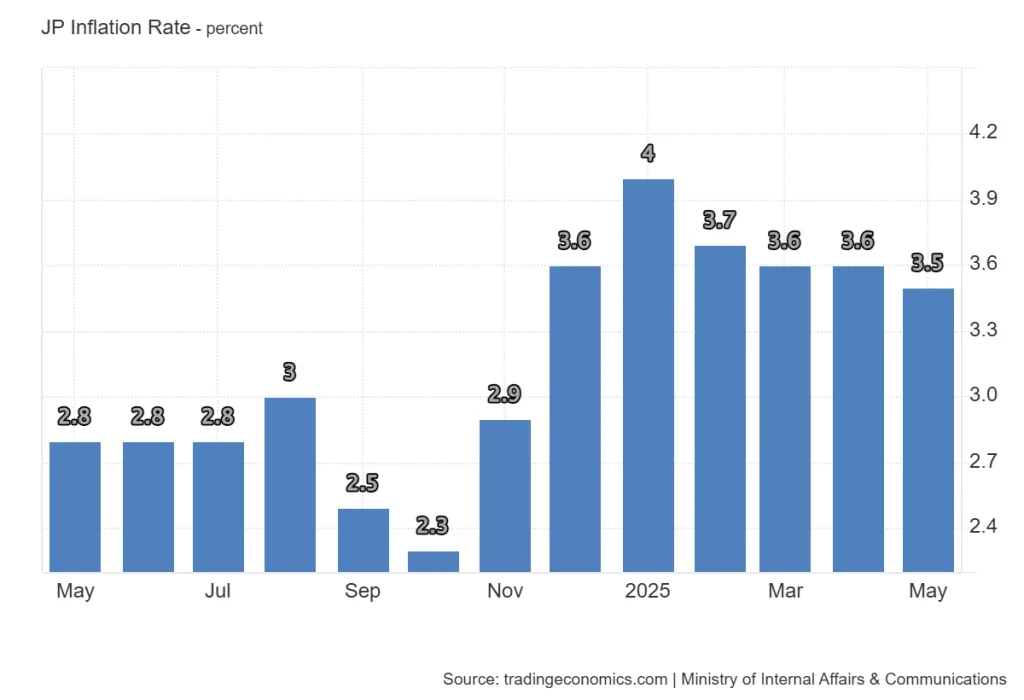

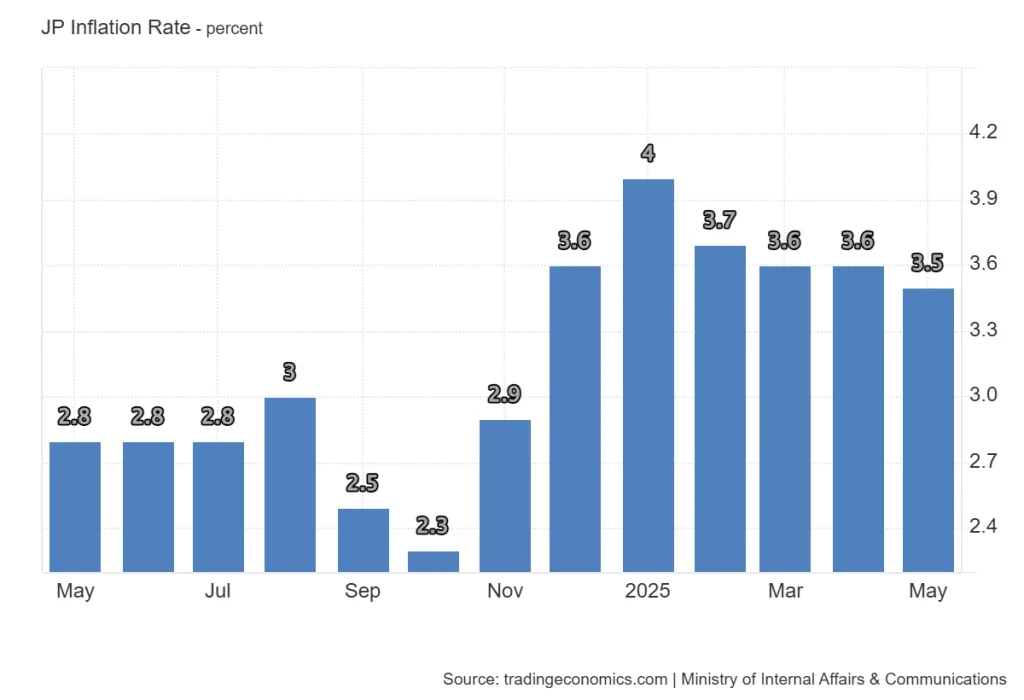

Meanwhile, the annual inflation rate of Japan represents approximately 3.5%. In October 2024, it was 2.3%. He culminated at 4% in January 2025, then remained between 3.6 and 3.7% in the following months. This means that most savings lose value in real terms.

The yield on the Japanese government obligation at 10 years is currently 1.45%. In March, it was slightly higher at 1.63%. Japanese life insurers, which manage approximately 390 yen billions, are now looking for better yields to meet long -term obligations.

Livingston also notes that regulators in Japan encourage the development of new financial products that offer higher yields without adding currency risks.

Metaplanet solution: privileged stock supported by Bitcoin

Metaplanet aims to solve this problem by launching a favorite stock supported by Bitcoin. The stock will be issued in Japanese Yen and will offer high yields from 9 to 10% per year.

Bitcoin is known for its appreciation of long -term prices and is often considered as coverage against inflation. This makes it an attractive asset to support fixed income securities.

- Read also:

- America’s “Crypto“ week ”set for mid-July to advance key blockchain bills

- ,,

Strategic growth and accumulation of bitcoin

Metaplanet is already a major Bitcoin holder, with at least 13,350 BTC, worth more than $ 1.45 billion. Livingston says that the company can use funds collected thanks to these favorite actions to buy more bitcoin. As their Bitcoins farms are increasing, the value of the warranty increases. This could allow Metaplanet to reduce coupons in future offers and reduce capital costs.

The long -term objective of the company is to accumulate 210,000 BTC, which would represent approximately 1% of the total Bitcoin supply.

A major change in the Japan financial system

Livingston thinks that this new offer is not only another product. It represents a major change in the financial system of Japan. An investment in yen worded and supported by Bitcoin could provide better yields to savers, modernize the capital markets and avoid the risks of exposure to foreign currencies.

This decision could establish a new standard for fixed income investments in Japan.

Never miss a beat in the world of cryptography!

Stay in advance with the news, expert analysis and real -time updates on the latest Bitcoin, Altcoins, DEFI, NFTS, etc. trends

Faq

Metaplanet addresses the financial market problems of Japan, where more than 2,200 Yen Billions in safeguard earn less than 0.23% interest while inflation works around 3.5%. This new product offers significantly higher yields (9-10%) and is encouraged by regulators looking for new financial products at risk of higher and more foreign money.

Metaplanet is a major Bitcoin holder, currently having at least 13,350 BTC, worth more than $ 1.45 billion. The company aims to accumulate 210,000 BTC, which would represent approximately 1% of the total bitcoin offer, using funds collected from these favorite actions to extend its assets.

This new offer offers Japanese savers much higher yields than traditional deposits or state bonds. It should modernize the capital markets of Japan by introducing an investment made from Yen and supported by Bitcoin, offering better yields while avoiding exposure to foreign currencies, possibly established a new standard for fixed income investments.