- The latest global adoption index of the channel channel chain shows that the United States has reached second place, while India has held its advance for the third consecutive year, first ranking on the four deprivations.

- The Asia-Pacific Region (APAC) has become the quickest center for the adoption of cryptography, its total transaction volume amount of 69% to reach 2.36 dollars of dollars in the 12 months ending in June 2025.

- The report highlights an increasing divergence between adoption led by the institution on developed markets and basic adoption in emerging economies, where stablecoins like the USDT and USDC are vital for funding.

The United States has gone from the fourth to second place for the adoption of cryptography in the chain channel’s world adoption index in 2025, a change that was motivated by regulatory changes and large entries in the ETF Bitcoin and Ether.

But India has kept its advance for the third consecutive year, ranking first in the four sub-indexes covering centralized retail, institutional, DEFI and decentralized services.

APAC leads the wave of the adoption of cryptography

The report detailed that in June 2025, the APAC became the region for the fastest growth for transactions linked to the crypto:

During the 12 months ending in June 2025, the APAC became the region for the fastest growth for cryptographic activity on a chain, with an increase of 69% of one year on the other received. The total volume of cryptographic transactions in APAC increased from $ 1.4 billion to $ 2.36 billions of dollars, driven by a robust commitment on the main markets such as India, Vietnam and Pakistan.

Chain-analysis

Chain-analysis Find out more: XRPL Gamechain brings crypto games to the big book XRP

Similarly, North America treated US $ 2.2 T $ 3.40 T), up 49%, while Europe reached US $ 2.6 T $ 4.02 T), up 42%. Latin America has also increased by 10%, with Brazil, Argentina and Venezuela in the first twenty.

Emerging institutions and savings

The analysis chain said that the classification underlines how the adoption of the crypto is now diverge between the institutional developed markets and the developed and those emerging markets based on the basis, where the stablecoins remain vital for funding and economies.

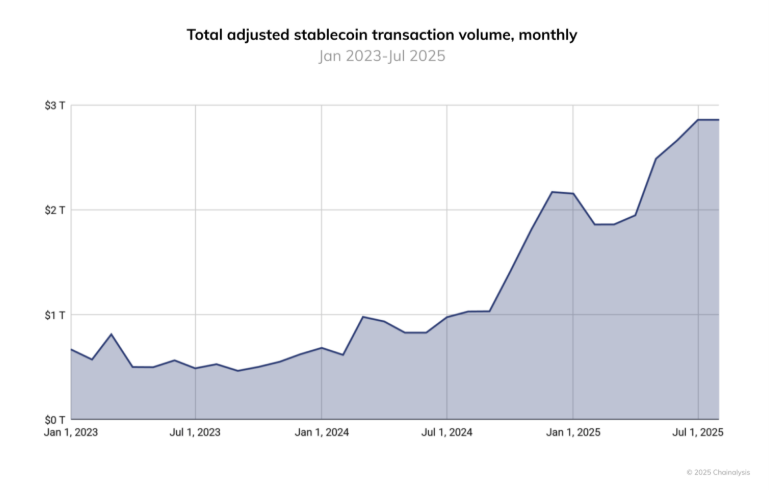

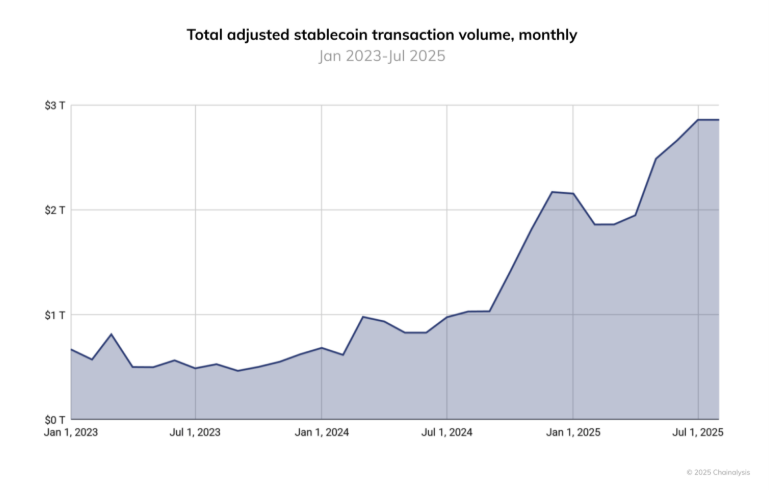

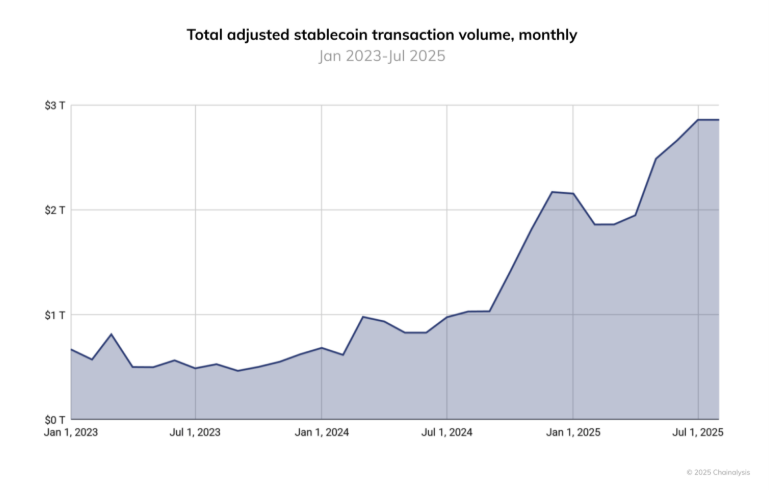

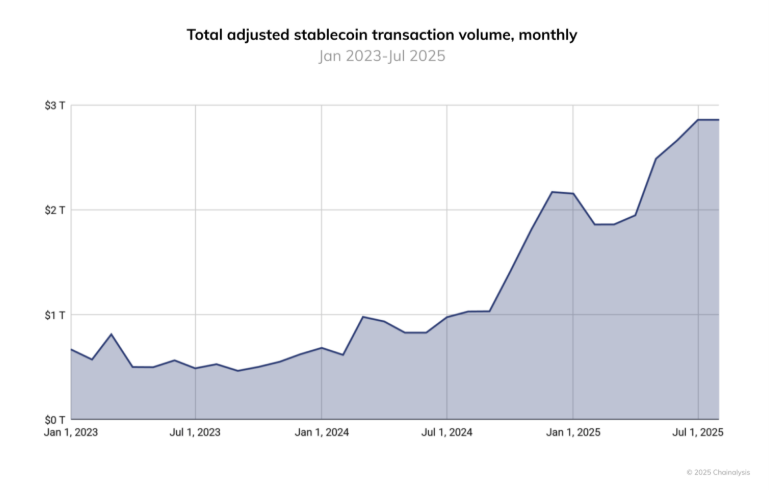

Naturally, the USDT and the USDC dominate funds, upgrade almost all the other stablescoin by looking at the scale; From June 2024 to June 2025, the USDT treated more than 1 Billion of US dollars (1.55 Billion in) in transactions each month, culminating at 1.14 dollars ($ 1.76 billion in) in January 2025.

The USDC varied from 1.24 Billion of US dollars (1.92 Billion to) at 3.29 Billions of US dollars (5.09 billions of dollars in), with the largest activity in October 2024.

This does not mean that other important stablescoin stables were held behind, as shown in the report:

Smaller stables like Eurc, Pyusd and Dai have experienced rapid growth. The EURC increased by almost 89% on average by one month, the monthly volume from around $ 47 million in June 2024 to more than $ 7.5 billion in June 2025. Pyusd also showed sustained acceleration, from around $ 783 million to $ 3.95 billion in the same period.

Chain-analysis

Chain-analysis On this note, the Stablescoin market recently reached a record of 280 billion US dollars (426 billion dollars in market capitalization, as reported by Crypto News Australia, and it is expected to exceed 400 billion US dollars ($ 609 billion in) by the end of this year.

In relation: Coinbase reveals Mag7 + Crypto Equity Index Futures