This article is an extract from our geography of cryptocurrency 2023 report. Download your copy now!

We are delighted to unveil the fourth annual adoption index of the cryptography of the cryptography of the chain chain. The objective of the index is simple: we combine data on the chain and real data to measure which countries lead the world in adoption of popular cryptography. The adoption of the basic crypto does not concern countries with the highest raw transaction volumes – everyone could probably guess that the largest and richest countries are well in advance. Instead, we want to highlight the countries where medium and everyday people adopt the crypto the most. To do this, we have designed the global cryptography adoption index to identify the countries where most people put the largest share of their wealth in cryptocurrency. We will explain the complete methodology below, then provide the first 20 countries in our index, as well as some key points to remember.

Continue to read and we will discuss:

Our global methodology for the Crypto adoption index

The global cryptography adoption index is made up of five sub-indexes. Each of these sub-index is based on the use of different types of cryptocurrency services. We classify the 154 countries for which we have enough data on each sub-index, weighted the classification by characteristics such as the size of the population and the purchasing power, take the geometric average of the classification of each country in the five, then normalize this final number on a scale of 0 to 1 to give each country a score which determines the global classification. The closer 1 the final score of the country, the higher the rank.

In order to calculate our sub-index, we estimate the transaction volumes for countries for different types of cryptocurrency services and protocols based on the web traffic models of these services and protocols websites. We recognize that data on web traffic is not perfect. Some crypto users almost certainly use VPNs and other tools that mask online activity. But since our index takes into account hundreds of millions of transactions and 13 billion web visits, we are convinced that any poorly attributed transaction volume due to VPNs is too small to compromise data as a whole. We also examine our index with experts and operators of local cryptos around the world, which gives us more confidence in this methodology.

You will find below a description of each sub-index, how it is calculated and why we think it is useful to measure the adoption of popular cryptography.

Cryptocurrency value in chain received in centralized exchanges, weighted by the parity of purchasing power (PPP) per capita

The objective of this sub-index is to classify each country by a total cryptocurrency activity occurring on centralized cryptography exchanges and weighing the classification to promote countries where this amount is greater according to the income of the average person of this country. We calculate this by estimating the total cryptocurrency received on the chain by users of centralized services in each country and by weighted this value based on the PPP per capita, which is a measure of the country’s income per resident. The higher the value of the value on chain, the higher the classification. In other words, if two countries received equal quantities of cryptocurrency at the centralized services, the country with a lower PPP would be classified.

Retail value in chain received in centralized exchanges, weighted by PPP per capita

The objective of this metric is to measure the activity of non-professional individual cryptocurrency users in centralized services, depending on the amount of cryptocurrency they transmit compared to the purchasing power of the average person. We do this by measuring the amount of the cryptocurrency received in the services centralized by users of each country, similar to the above, but counting only the value received in retail transactions, which we designate as transactions of less than $ 10,000 USD of cryptocurrency. We then classify each country according to this metric, but the weights to promote countries with a PPP per inhabitant lower.

Peer-to-Peer (P2P), weighted by PPP per capita and number of internet users exchange volume and number of internet users

The volume of P2P trade represents a significant percentage of all cryptocurrency activities on emerging markets. For this sub-index, we classify the countries by their P2P volume of business and the layers to promote countries with a lower PPP per capita and less Internet, the objective is to highlight the countries where more residents put a greater part of their overall income and their wealth in the P2P cryptocurrency transactions.

Chain cryptocurrency value received from DEFI protocols, weighted by PPP per capita

DEFI (decentralized finance) is the edge of cryptocurrency. Given the importance of the sector for crypto innovation, we want our adoption index to highlight the countries where users conduct a disproportionate part of their financial activity using Defi protocols. For this sub-index, we classify the countries by their volume of transactions DEFI and laying the classification to promote countries with a PPP per capita lower.

Retail value in chain received from DEFI protocols, weighted by PPP per capita

We want our index to highlight the DEFI activity of non-professional individual cryptocurrency users, just as we do for centralized services. Thus, this sub-index classifies each country by the DEFI transaction volume made in transfers of the size of the retail, weighted to promote countries with a lower PPP per capita.

The global adoption index of the crypto-2023 TOP 20

| Country | Region | Overall index classification | Centralized service value classification result | Centralized retail service value received the ranking | Classification of the volume of P2P exchange exchanges | Challenge the classification received | Retail sale reservation reservation |

| India | Central and South Asia and Oceania | 1 | 1 | 1 | 5 | 1 | 1 |

| Nigeria | Sub -Saharan Africa | 2 | 3 | 2 | 1 | 4 | 4 |

| Vietnam | Central and South Asia and Oceania | 3 | 4 | 4 | 2 | 3 | 3 |

| UNITED STATES | North America | 4 | 2 | 8 | 12 | 2 | 2 |

| Ukraine | Eastern Europe | 5 | 5 | 3 | 11 | 10 | 10 |

| Philippines | Central and South Asia and Oceania | 6 | 6 | 6 | 19 | 7 | 7 |

| Indonesia | Central and South Asia and Oceania | 7 | 13 | 13 | 14 | 5 | 5 |

| Pakistan | Central and South Asia and Oceania | 8 | 7 | 7 | 9 | 20 | 20 |

| Brazil | Latin America | 9 | 9 | 11 | 15 | 11 | 11 |

| Thailand | Central and South Asia and Oceania | 10 | 8 | 15 | 44 | 6 | 6 |

| China | East Asia | 11 | 10 | 5 | 13 | 23 | 23 |

| Türkiye | Middle East and North Africa | 12 | 11 | 9 | 35 | 12 | 12 |

| Russia | Eastern Europe | 13 | 12 | 10 | 36 | 9 | 9 |

| United Kingdom | Central, North and Western Europe | 14 | 15 | 20 | 38 | 8 | 8 |

| Argentina | Latin America | 15 | 14 | 12 | 29 | 19 | 19 |

| Mexico | Latin America | 16 | 17 | 18 | 30 | 16 | 16 |

| Bangladesh | Central and South Asia and Oceania | 17 | 18 | 19 | 33 | 22 | 22 |

| Japan | East Asia | 18 | 22 | 21 | 49 | 18 | 18 |

| Canada | North America | 19 | 25 | 23 | 62 | 14 | 14 |

| Morocco | Middle East and North Africa | 20 | 27 | 25 | 21 | 26 | 26 |

The first key to remember here is that the Central and southern region of Asia and Oceania (CSAO) Dominates the summit of the index, with six of the first ten countries located in the region. As we explore in the full report, the circumstances stimulating adoption in each country of the CSAO are unique, which leads to different trends of use and the most popular breakdowns.

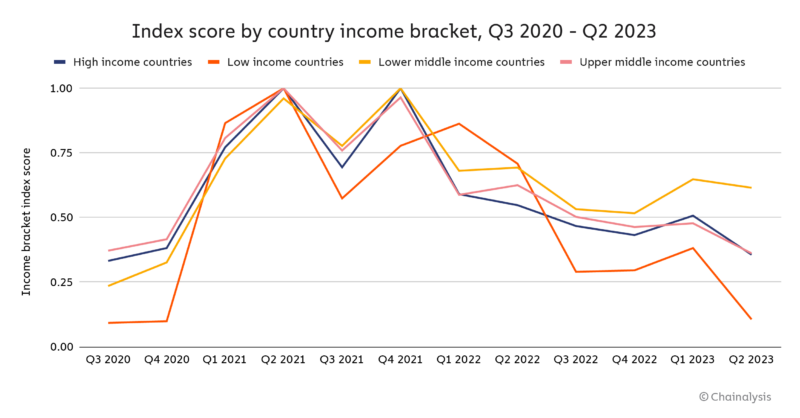

Global adoption is decreasing, but not in a crucial subset of the world

There is no sugar sugar: the adoption of the global basic crypto is decreasing. We can see it on the graph below, where we apply our adoption index methodology on a global scale by adding the index scores of the 154 countries for each quarter of the third quarter 2020 to the present day, and reindex them again to show the growth of adoption in time in the world.

Although there has been a marked recovery since the marasm of the end of 2022, roughly at the time FTX implodedThe basic adoption is still well outside its heights of all time.

But it is not true everywhere. More specifically, there is a crucial segment of countries where basic adoption has experienced a much stronger recovery than everywhere else: countries with lower average income (LMI). LMI is one of the four designations Used by the World Bank To classify countries by the income level, depending on gross national income (GNI) per capita. These categories are as follows:

| World Bank income classification | GNI per capita | Country example |

| High income (HI) | > $ 13,205 | United States, United Kingdom, Saudi Arabia |

| Higher average income (UMI) | $ 4,256 – $ 13,205 | Argentina, China, Russia |

| Lower average income (LMI) | $ 1,086 – $ 4,255 | India, Nigeria, Ukraine |

| Low income (Li) | <$ 1,085 | Ethiopia, Sudan, Yemen |

Many of the best countries in our adoption index of global cryptography, Central Asia and South in Africa, appear in the LMI category, and taken together, the countries of the IML have experienced the greatest recovery in the adoption of popular cryptography in the past year. In fact, LMI is the only category of countries whose total basic adoption of the base remains greater than it was in the third quarter of 2020, just before the most recent bull market.

This could be extremely promising for Crypto’s future prospects. IMI countries are often increasing, with dynamic and growing industries. Many of them have undergone significant economic development in recent decades to switch from the low -income group. And maybe the most important of everyone, 40% of the world’s population lives in IML countries – more than any other category of income. If LMI countries are the future, data indicate that crypto will be a large part of this future. This, combined with the fact that Institutional adoption – mainly motivated by organizations in high -income countries – continues to gain steam even during the winter of current cryptography, depicts a promising table of the future. We could see a bottom combination And Adoption of the descending cryptocurrency in the near future if these trends take place, because digital assets meet the unique needs of individuals in the two segments. We will explore these trends and more in our full geography of cryptocurrency 2023.

This equipment is for information purposes only and is not intended to provide legal, tax, financial or investment advice. The recipients must consult their own advisers before making these types of decisions. The analysis chain has no responsibility for any decision taken or any other act or omission in relation to the use by the recipient of this material.