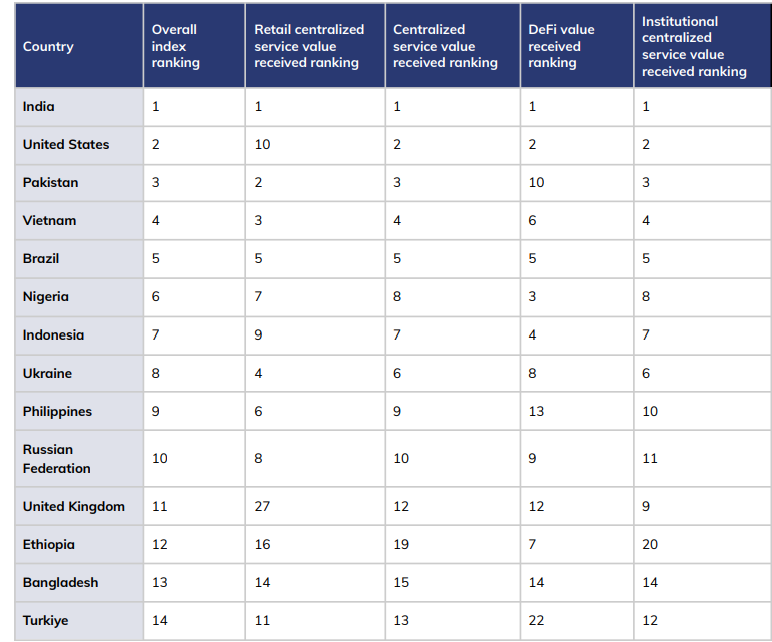

Crypto adoption has exploded around the world, moving from a niche speculation to a mainstream financial tool. By 2025, more than 560 million people own cryptocurrencies worldwide, representing 6.8% of the population, a massive jump driven by remittances, inflation hedging and institutional entry. Emerging markets lead local usage, while developed countries dominate institutional flows, according to the 2025 Global Crypto Adoption Index and Triple-A data from Chainalysis.

Image Source: Channel Analysis

This blog ranks the top countries leading global crypto adoption, analyzing on-chain activity, ownership rates, transaction volumes, and unique factors. From India’s retail dominance to the rise of institutional power in the United States, find out why these countries are shaping the future of crypto.

India: Global leader in crypto adoption

India leads Chainalysis’s 2025 Global Adoption Index, ranking first across retail, DeFi, and institutional metrics. With 93-119 million owners (6.55% of 1.4 billion population), India processes huge on-chain volumes despite regulatory hurdles.

Key factors:

- Remittances: Annual inflows of over $100 billion favor cheap stablecoin transfers over banks.

- Youth Adoption: Millennials/Gen Z (75% under 35) are driving P2P commerce via UPI-crypto bridges.

- DeFi Boom: High mobile penetration fuels DEX usage.

Statistics: 69% YoY growth in APAC, led by India; ranks #1 in Chainalysis sub-indexes.

The Indian crypto market reached $2.6 billion in 2024, and is expected to reach $15 billion by 2035, with cities like Bengaluru and Mumbai leading the way, but tier 2 hubs like Jaipur are growing.

United States: institutional power

The US ranks second overall (Triple-A: 15.6% ownership, 52 million users), dominating absolute volumes ($2,000+ on-chain) via ETFs and regulated platforms.

Key factors:

- Spot Bitcoin ETF: Inflows of over $50 billion in 2025 legitimize crypto for retirements.

- Regulatory Clarity: GENIUS Act and CFTC Approvals Drive TradFi Integration.

- Technology hubs: Silicon Valley and New York stimulate venture capital funding ($10 billion and more).

Statistics: Increase in activity of 50% over one year; leads in North America with institutional transfers > $1 million.

Pakistan: rise of emerging markets

Pakistan (No. 3 on Chainalysis) claims a 6.6% stake (15.9 million users), fueled by economic instability and remittances from freelancers.

Key factors:

- Inflation Hedge: Inflation over 25% pushes savings into USDT.

- P2P domination: LocalBitcoins type transactions escape banking restrictions.

- Youth remittances: More than 10 million freelancers prefer cryptocurrency payments.

Statistics: The local APAC leader; top 5 for detail size transfers.

Vietnam: a mobile-focused powerhouse

Vietnam (No. 4) has a 21.2% stake (20.9 million users), putting it at the top of ASEAN in terms of transaction volume, alongside Thailand.

Key factors:

- Gaming/NFT: Axie Infinity popularized crypto earnings.

- Cross-border trade: Stablecoins regulate Vietnam-China trade.

- Young tech-savvy people: 70% under 35 own crypto.

Statistics: Consistent ranking in the top 5 of Chainalysis; high DeFi engagement.

Brazil: the crypto capital of Latin America

Brazil (#5), with 12% ownership (26 million users), processes over $500 billion on-chain, due to inflation and elections.

Key factors:

- Pix integration: instant fiat-crypto ramps.

- Election Bets: 2025 Polls Increased DEX Volume.

- Remittances: $4 billion in annual flows via stablecoins.

Statistics: Leader in Latin America with growth of 63% year-on-year.

| Region | Annual growth | Key leader |

| Asia-Pacific | 69% | India |

| Latin America | 63% | Brazil |

| Sub-Saharan Africa | 52% | Nigeria |

| North America | Constant | WE |

Why emerging markets are leading adoption

Low/middle income countries dominate the Chainalysis top 20 (15/20 places) due to:

- Economic necessity: Hyperinflation (Venezuela, Argentina) makes dollar stability vital.

- Remittances: $800 billion global flows favor 1-2% crypto fees versus 7% transfers.

- Banking gaps: 1.4 billion unbanked people prefer mobile wallets.

- Mobile first: 80% smartphone penetration in Vietnam/India compared to existing systems elsewhere.

High-income countries (US, UK) excel in institutional activity, ETFs and tokenized assets, but lag behind locally.

Obstacles and future enablers

Challenges:

- Regulations: the Indian tax of 30% deters some; Banking bans in Nigeria persist.

- Infrastructure: high costs in Africa; scams erode trust.

- Contagion of volatility: The crashes of 2022 hit retail the hardest.

Catalysts 2026:

- Stablecoin laws (US GENIUS Act global model).

- CBDC: more than 130 drivers integrate cryptographic rails.

- Layer 2 Scaling: Lower Fees Drive Emerging Markets.

Conclusion

India, the United States, Pakistan, Vietnam, and Brazil are leading global crypto adoption with their complementary strengths: local necessity meets institutional scale. Emerging Asia and Latin America are driving volume growth (69%/63% YoY), while North America is institutionalizing crypto via ETFs and policy. With over 560 million owners and $2.36 billion in APAC activity, adoption is proving resilient, solving remittances, inflation, and inclusion where fiat currency fails. 2026 favors mobile-first nations, connecting retail hype with regulatory maturity, thereby cementing crypto as borderless finance.

Overall, ZebPay blogs are here to provide you with crypto wisdom. Get started today and join over 6 million registered users to explore the endless features of ZebPay!

FAQs

Which country leads global crypto adoption?

India leads the Chainalysis 2025 Index for retail/DeFi/institutional metrics.

Why are emerging markets adopting crypto the fastest?

Remittances, inflation hedging, unbanked populations, cryptography solves the real problems ignored by banks.

What is crypto adoption in the United States?

Institutional dominance: ETFs and regulated platforms generate volumes of over $2 trillion.

How many Indians own crypto?

93-119M (6.55% of the population), absolute figures in the lead.

Will adoption continue to grow?

Yes, stable laws, L2 scaling and CBDC pilots accelerate the 2026 momentum.

Disclaimer:

Crypto and NFT products are unregulated and can be very risky. There can be no regulatory remedy for any losses resulting from such transactions. Each investor should carry out their own research or seek independent advice if necessary before initiating any transaction in crypto products and NFTs. The views, thoughts and opinions expressed in the article are those of the author alone, and not of ZebPay or the author’s employer or any other groups or individuals. ZebPay cannot be held responsible for any acts, omissions or losses suffered by investors. ZebPay has not received any compensation in cash or kind for the above article and the article is provided “as is” without any guarantee of completeness, accuracy, timeliness or the results obtained from the use of this information.