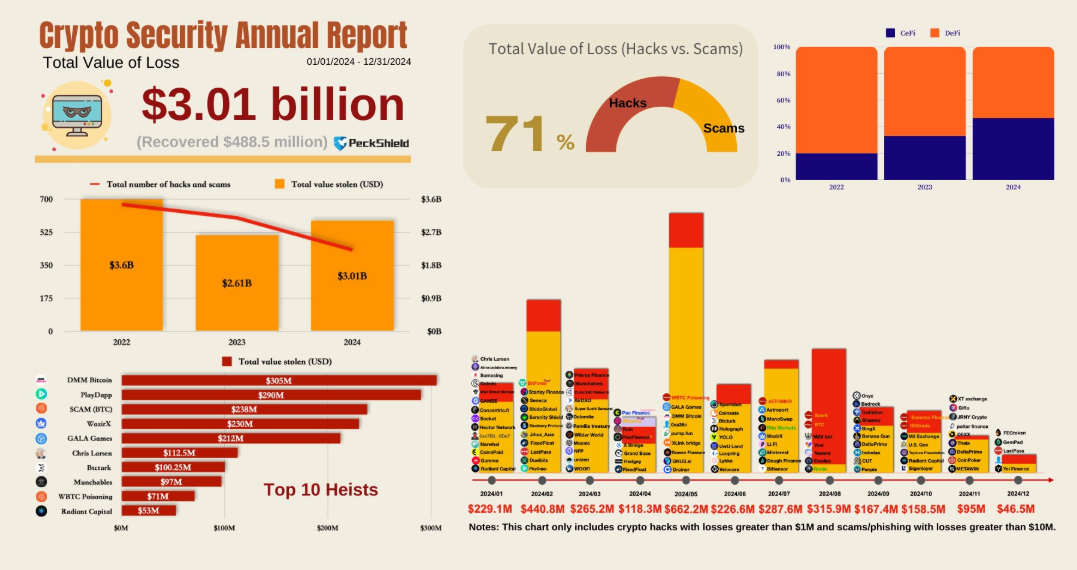

According to a report from blockchain security firm PeckShield, the cryptocurrency industry saw a sharp increase in security breaches in 2024, with losses totaling $3.01 billion.

This represents a 15% increase from $2.61 billion in 2023, reflecting the growing vulnerabilities of the rapidly evolving digital asset market.

Peck ShieldIt is Distribution of crypto losses in 2024

PeckShield’s analysis shows that the bulk of 2024 losses came from crypto hacks, which accounted for $2.15 billion, or 71% of the total. The remaining $834.5 million came from various scams, such as phishing attacks, Ponzi schemes and fraudulent investment platforms.

Despite these massive losses, efforts to recover the stolen funds have had some success. According to PeckShield, approximately $488.5 million worth of cryptocurrencies have been recovered through blockchain tracing and enforcement actions.

The report also highlights the top 10 heists of the year, highlighting the significant scale of individual incidents. These ranged from breaches of decentralized finance (DeFi) platforms to targeted attacks on major exchanges. Notable incidents include:

- AlphaX DeFi Hack — $320 million stolen in February.

- Lumos Bridge Feat — $250 million drained in July.

- DeltaTrade exchange breach — $180 million stolen in October.

These high-profile cases indicate the ongoing security challenges within the DeFi ecosystem. This suggests that the sector remains a prime target for hackers due to its open source nature and vast pool of digital assets.

Monthly Hacking Activity Trends

A bar chart accompanying the report illustrates the distribution of losses throughout the year. As the chart below indicates, spikes were seen in March and September, coinciding with major protocol vulnerabilities and periods of increased market activity.

The increase in attacks during these months indicates the need for continuous security audits and real-time monitoring of smart contracts. While losses were dominated by hacks, scams also played a significant role. Fraudsters have taken advantage of the growing adoption of cryptocurrencies, targeting inexperienced users with promises of high returns.

One of the biggest scams of the year involved a fake investment platform that siphoned $140 million from unsuspecting investors before disappearing. This incident reflects the importance of public education and thorough due diligence to mitigate risks.

The rise in crypto-related crimes has attracted the attention of regulators and law enforcement around the world. In November, the National Gaming Authority (ANJ) opened an investigation into fraudulent crypto operations.. Elsewhere, the FBI has worked closely with blockchain analytics companies to recover stolen funds and prosecute offenders.

PeckShield’s report highlights the importance of caution from crypto market participants as the sector continues to grow.

“The crypto Wild West is alive and well. The $3 billion lost in 2024 shows that the stakes are higher than ever. It’s time to strengthen those digital defenses or risk becoming an easy target,” said one X user. commented.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to providing unbiased and transparent reporting. This news article aims to provide accurate and current information. Readers are, however, advised to independently verify the facts and seek professional advice before making any decision based on this content. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.