The main dishes to remember:

- According to River Financial data, the adoption of Bitcoin in 2025 represents only 4% of the world’s population.

- Although it is individual investors who have fueled the rise of bitcoin, it is today institutional investors whose capital takes place in Bitcoin thanks to ETF investments.

- Lack of education and fear of volatility continue to be major obstacles to general adoption.

New York – the global adoption of Bitcoin is still shocking, with only 4% of the world’s population holding Bitcoin in 2025, according to A new River Financial research reportBetter Bitcoin financial services company. Although institutional interest increases and regulatory efforts have been widely observed in a positive day of Bitcoin defenders, the report notes that Bitcoin still has a long way to go before being accepted by the dominant current.

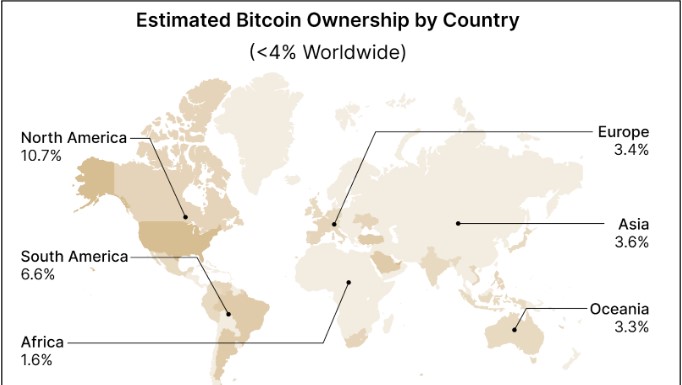

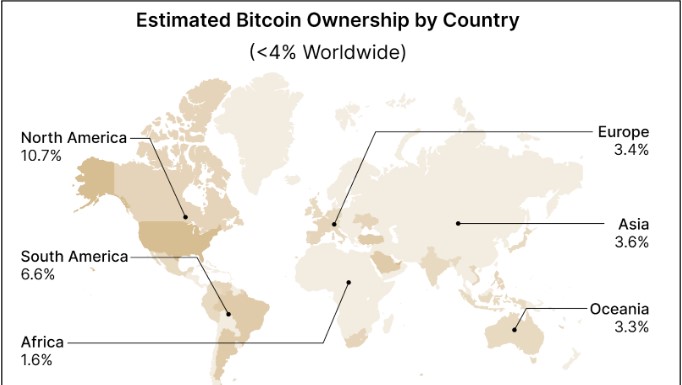

Global adoption card: North America directly in front, Africa far behind

Regional disparities in the adoption of Bitcoin The River Report report. North America has the most estimated adoption at 10.7%, due to high levels of financial literacy, advanced technical infrastructure and relatively favorable regulatory environments. Europe then comes with 3.4% of all adoptions from the region, while South America was 6.6%. The continent unfortunately reduces the global average, with only 1.6% of its population using bitcoin, with challenges such as low levels of financial education, limited access to technology and, in many cases, restrictive regulatory policies.

“While Bitcoin has made significant progress in certain regions, its adoption in the world is still at an emerging stage”, ” said Sam Baker, principal author of the River Financial Report. “Our data show that we are only about 3% of the maximum adoption potential of Bitcoin, highlighting considerable growth opportunities.”

The Bitcoin Landscape 2025: Key results

The river report describes in detail the current Bitcoin ecosystem, covering many trends:

- Development of the current protocol: Since Bitcoin relies on an open source code base, it can undergo continuous development; In 2024, only, there were more than 2,500 code of code. And a dedicated community of developers works to extend its features and secure it.

- Decentralize the hashrate: Bitcoin mining hashrate is more and more decentralized, which reduces the potential of a 51%attack. Today, the United States dominates – representing around 36% – but a few others also have its share, notably Russia (16%) and China (14%).

- Decrendy offer growth: The growth of the Bitcoin supply is slowed down, is now increasing at a lower rate than traditional assets such as American dollar and gold. This limited offer makes Bitcoin even more attractive in terms of value storage.

Institutional power game: In the United States, FNB Bitcoin has reached $ 100 billion and institutional investors become serious movers behind the Bitcoin price. Bitcoin is on the way to healing funds, showing broader institutional acceptance of the active.

Which holds the keys – the property of Bitcoin

The report highlights the distribution of Bitcoin property, revealing the main actors:

- Fortune Bitcoin by Satoshi Nakamoto: The pseudonym creator of Bitcoin, Satoshi Nakamoto, is estimated to be the holder of 968,452 BTC of approximately $ 94 billion in December 2024. These pieces are still in sleep, which only adds to mystics surrounding Bitcoin’s creativity.

- Microstrategy: Michael Saylor has taken a remarkable bet with microstrategy by stacking BTC as a business treasury actor on the balance sheet with 499,096 BTC. Such an aggressive strategy has positioned microstrategy as a leader in Bitcoin space.

State accumulation: If you thought companies were the only stacked with Bitcoin, wait until you see what governments have in store when they start confiscating bitcoins at El Salvador or acquiring them by other methods.

Obstacles to mass adoption: education and volatility

The report has identified three major obstacles which remain a barrier to the wider absorption of Bitcoin:

- Education gap: A high knowledge obstacle exists for potential users due to technical details and the ultimate rarity of Bitcoin. This trend is also due to a general lack of understanding that feeds skepticism and ultimately stops a broader adoption.

- Volatility concerns: The infamous volatility of bitcoin and reality, in particular in the development of portfolios or economically outdated countries, is that stablecoins can be a more stable option.

- Limited scalability: The Bitcoin network does not support scalability; He also has transaction costs. They can hinder its use for daily transactions, in particular compared to traditional payment systems.

More news: The CEO of Coinbase provides that 10% of world GDP is in the cryptographic industry by 2030

The Lightning Network: a slowdown in slow motion

According to the report, the Lightning network is developed continuously, but its growth is quite slow. The Lightning network is designed to accelerate the treatment of transactions.

The way to follow: publication of growth catalysts

Despite these challenges, the River Financial Report identifies some key catalysts that could stimulate the adoption of bitcoin in the coming years:

- Greater educational efforts: It is of the utmost importance of increasing education efforts around Bitcoin to break the knowledge barrier and financial literacy.

- Continuous institutional acceptance:The ongoing torrent of institutional capital in the Bitcoin FNB would have built more legitimacy around the asset class, thus attracting even more capital.

- Increased adoption of the business treasury: The trend of companies adding bitcoin to their cash reserves, as we can see with Microstrategy, is likely to continue and take more momentum, joining the place of Bitcoin in the financial ecosystem.

- Regulatory clarity: While regulators have started to create lighter and more favorable regulatory executives for Bitcoin around the world, such as Bitcoin Spot ETF, investors’ confidence and adoption are likely to follow the step.

- Geopolitical factors: Economic uncertainty throughout the world as well as fears about the stability of conventional currencies can power the interest of bitcoin as a security actor.