THE Ethereum (CRYPTO: ETH) the cryptocurrency was worth around $2,220 in September. On January 6, it stood at $3,636.

THE smart contract platform continue to soar in 2025? Let’s see if Ethereum could offer a price of $5,000 soon.

Where to invest $1,000 right now? Our team of analysts has just revealed what they think is the 10 best stocks buy now. See the 10 values »

The crazy adventure of Ethereum for four years

The cryptocurrency market as a whole tends to move in fairly predictable four-year cycles. This cadence is determined by the pre-planned plan Bitcoin (CRYPTO:BTC) the halving of events as well as the growing public interest in crypto-based technology solutions and investments.

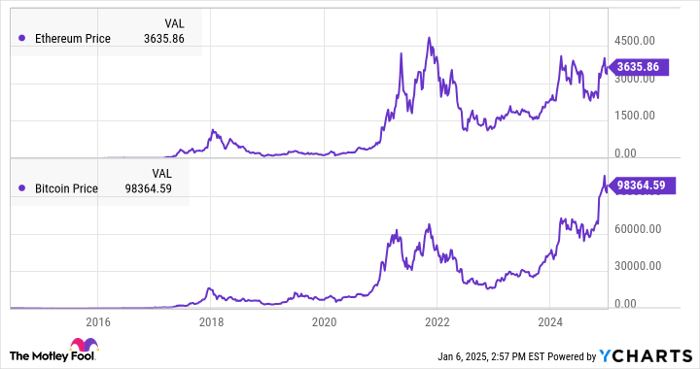

Launched 6 years after Bitcoin, Ethereum has only experienced two full boom and bust cycles. However, its price chart showed very typical trends over time consistent with Bitcoin’s fluctuations:

Ethereum Price data by Y Charts

As such, this cryptocurrency appears poised to skyrocket in 2025. Keep in mind that recent gains have not brought Ethereum back to the all-time highs of 2021, when the token briefly traded at $4,815 . Considering historical market trends, Ethereum is expected to easily reach the $5,000 watermark in 2025.

Fuel for Ethereum’s Growth Engines

But graphical models never tell the whole story. There are several significant catalysts that promise to drive Ethereum’s price higher this year, regardless of broader crypto market trends and price trends in 2021 and 2017.

-

It is the only cryptocurrency not named Bitcoin to have a exchange traded funds (ETFs) based on it. Led by the Grayscale Ethereum Trust ETF (NYSEMKT: ETHE) And iShares Ethereum Trust ETF (NASDAQ:ETHA), THE Ethereum ETF have accumulated $11.5 billion in assets under management (AUM) in less than 6 months. This influx of dollar investment funds could accelerate in 2025.

-

Around 28% of all Ethereum tokens are currently staked, generating dividend-like payouts while strengthening the blockchain network’s cryptographic security model. This represents an increase from 24% a year ago and 8% in January 2022. The upward trend suggests broader interest in holding Ethereum for the long term.

-

Decentralized financing solutions is expected to disrupt traditional banking in the long term, but people have not yet grasped this idea. Ethereum and other smart contract tokens are expected to skyrocket if and when these blockchain-based financial solutions become mainstream, with bankless financial tools in every smartphone. This leap could begin in 2025, although revolutionary tools often take time to go global.

The Many Achilles Heels of Ethereum

Past results are no guarantee of future performance, and this is especially true in the unpredictable cryptocurrency market. Ethereum could indeed trade sideways or down in 2025.

-

The Bitcoin Market Halving Cycle could play out differently this time, leaving Ethereum and other raiders without an expected value booster.

-

If the crypto sector as a whole skyrockets, Ethereum could break away from the broader trend if smaller but faster altcoins stealing market share in the field of smart contracts.

-

Recent and upcoming upgrades to Ethereum’s software may not deliver the expected benefits of faster contract processing and reduced transaction fees.

-

Investors could stop their asset inflows into Ethereum ETFs, preferring instead Bitcoin ETFs or a completely independent class of investment instruments.

Any or all of these potential threats could impact Ethereum’s value this year, and I’m only scratching the surface of a deep well of risks related to cryptocurrencies. This is why cryptocurrencies should represent a small part of your well-diversified investment portfolioeven in times when the entire market seems ready to soar.

The heavyweights of portfolio management Blackrock (NYSE:BLK) suggest allocating around 2% of your investments to Ethereum, Bitcoin and other cryptocurrencies. Your mileage may vary, but it’s a wise approach to the volatility of digital assets.

The Future of Ethereum and Your Crypto Investments

Ultimately, Ethereum still looks likely to reach $5,000 in 2025. This target is likely too conservative if market trends from previous crypto cycles hold true again.

Still, Ethereum remains a risky and unpredictable investment. Even if you think the token is currently undervalued, now is not the time to bet on just one idea. Wall Street is littered with the charred debris of seemingly bulletproof stocks, and the crypto world is no safer. Plan your Ethereum investments after check your appetite for market risks.

Should you invest $1,000 in Ethereum right now?

Before buying Ethereum shares, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Ethereum was not one of them. The 10 stocks selected could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $858,852!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of January 6, 2025

Anders Bylund has positions in Bitcoin and Ethereum. The Motley Fool posts and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.