Main regression: the effect of blockchain on the risk of corporate default

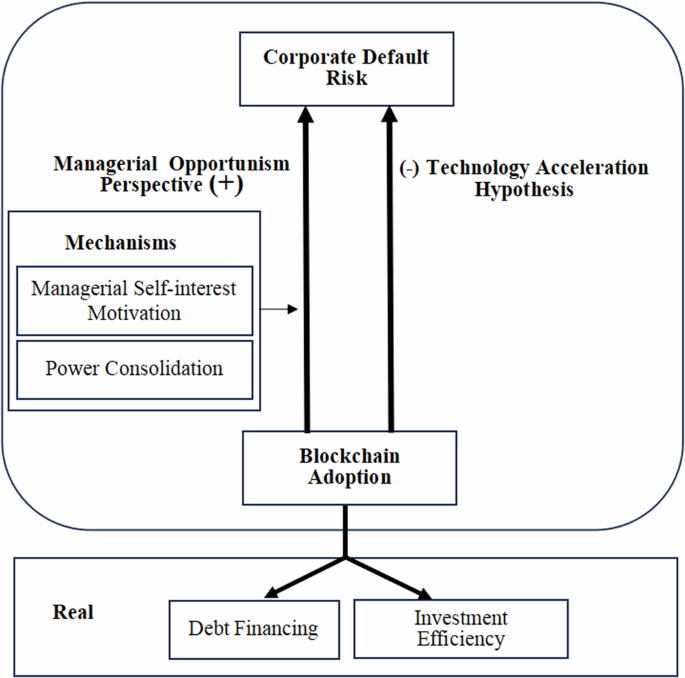

Table 4 presents the regression results of the relationship between blockchain technology adoption and corporate default risk. The results show that the coefficient of blockchain technology is 0.004 and significant at the 1% level, indicating that firms adopting blockchain technology significantly increase their default risk compared to firms without technology. This is consistent with the managerial opportunism hypothesis. This indicates that leaders are incentivized to strategically use blockchain technology to promote the market. The capital market “hype” for blockchain adoption is evident.

In the control variables, the coefficients Size and Lev are significant and positive, indicating that firms with higher debt ratios and larger sizes have a higher probability of default than other firms (Kong et al ., 2020). The coefficients of ROA, Growth, and Hold1 are significant and negative, indicating that highly profitable and growing firms obtain more trade credit than other firms (Chen and Ma, 2018). The SOE coefficient is also significant and positive, indicating that SOEs with higher bargaining power result in more defaults than other firms.

Mechanism: the effect of self-interest motivation of leaders

Management ownership redistributes shareholder interests, thereby reducing the wealth of existing shareholders. If the shareholding ratio exceeds a reasonable limit, it may lead to excessive executive compensation (Brown and Lee, 2010). Additionally, managerial ownership may increase management’s incentive to manipulate earnings and information (Cheng and Warfield, 2005; Brockman et al., 2010).

In the theoretical analysis, we posit that management, motivated by self-interest, may use blockchain technology to seek personal gains. For example, executives might intentionally exaggerate information regarding the effectiveness of blockchain applications to secure resources or manipulate market value. Due to information asymmetry, such manipulation of information is likely to influence market reactions, thereby leading to an increase in stock prices (Bloomfield, 2002), from which management can derive personal benefits .

We view managerial ownership as the self-interest of managers. Management ownership redistributes shareholder interests, thereby reducing the wealth of existing shareholders. If the shareholding ratio exceeds a reasonable level, it can lead to excessive executive compensation (Brown and Lee, 2010). Additionally, managerial ownership may increase the desire to manipulate earnings and information (Brockman et al., 2010).

We included several variables to represent management self-interest. First, we included change as the evolution of management ownership over the year (Zhang and Kyaw, 2017). If participation changed, it was recorded as 1; otherwise, it was recorded as 0. In order to study the different types of changes in shareholding in more detail, we also subdivided the changes in management ownership as follows: management ownership was reduced ( Sale) during the inspection period, in which case, the reduction in management ownership was recorded at 1; otherwise, it was recorded as 0. If management ownership increased (Purchase), the increase in management ownership during the above inspection period was recorded as 1; otherwise it was recorded as 0.

In column 1 of Table 5, the coefficient of the Change*Blockchain interaction is 0.008, at a significance level of 5%. In column 2, the Sell*Blockchain interaction term is 0.008, at the 1% significance level. In column 3, the results are insignificant in Buy*Blockchain. The results indicate that managers could gain benefits by changing their ownership, including selling shares for profit, rather than buying them.

Previous research has only focused on the different self-interested behaviors related to the adoption of blockchain technology. Griffins and Shams (2020) found that purchases with Tether could lead to significant increases in the price of Bitcoin. Similar results are found in the Mt.Gox Bitcoin exchange theft (Gandal et al., 2018). Our research used buying and selling activities to demonstrate self-serving managerial behavior. The results show that managers are more likely to make profits by selling rather than buying stocks.

Mechanism: the effect of the consolidation of power

An essential prerequisite for logical analysis is that when executive power is relatively concentrated, managers are more likely to use their consolidated power to weaken the oversight role of the board of directors (Finkelstein and D’aveni, 1994). . This allows them to exaggerate or manipulate the company’s disclosure and application of blockchain technology to achieve greater personal gains. Existing research has shown that the dual role of chairman and CEO is a significant indicator of the concentration of executive power. A CEO who is also chairman can use this power to manipulate board decisions to serve his or her own interests (Tuggle et al., 2010), adjusting company profits upwards (Davidson et al., 2004) and ultimately undermine the value of the company (Castañer). and Kavadis, 2013). This occurs when a CEO is also board chair, which can limit the board’s ability to discipline and harm the organization (Duru and Zampelli, 2016; Desai et al., 2003). When a company’s CEO is also chairman of the board, directors have conflicting goals. According to organizational theory (Finkelstein and D’aveni, 1994), this duality of the CEO establishes strong and clear leadership. However, according to agency theory, duality reduces the effectiveness of board control, thereby promoting the consolidation of the CEO’s position. Therefore, when the chairman also serves as CEO, due to his relatively concentrated power, this is more likely to reinforce the selfish motives of managers, making the relationship between blockchain technology and corporate defaults negative. more significant.

On the other hand, a good internal control environment helps limit the power of managers, so that the company has a better information environment (Jin and Myers, 2006), and can also reduce asymmetry of information between companies and investors, thus limiting the self-serving behavior of managers (Hutton et al., 2009). On the contrary, if the company’s internal control environment is poor, it will not be able to effectively limit the self-serving behavior of managers, which will make managers more likely to take self-serving actions, which will make the business more likely to default. Therefore, when the firm’s internal control is poor, constraints on managers’ power are weaker, increasing the likelihood that managers will be at higher risk of default for reasons of self-interest.

We used internal control and CEO dual responsibility as an indicator of CEO power consolidation. Internal control was measured according to the appropriateness of the conclusion of the internal control assessment report: if yes, the value was recorded as 0; otherwise, it was recorded as 1. Dual simultaneously represents the president and the general manager in one person. The value is 1 if true and 0 otherwise.

In column 1 of Table 6, we use CEO duality as an indicator of power consolidation. We define that if the CEO is appointed as a board member at the same time, the power of the CEO will be consolidated. The results show that the coefficient of the Dual*Blockchain interaction term is 0.009, at the 10% significance level. The results indicate that the risk of default is higher in a company with duality.

Similar results are presented in Table 6, column 2: we find that the Internal Control*Blockchain interaction term is 0.039, at a 1% significance level, while the Dual*Blockchain interaction term is 0.009, at a significance level of 10%. The results indicate that the relationship is more pronounced in firms in which CEO power consolidation is high.

The results are consistent with research by Yermack (2017). This article shows that consolidation of CEO power could exist in firms with lower costs, greater liquidity, more accurate recordkeeping, and ownership transparency. Our results demonstrate that concentrated CEO power could distort power transparency and reduce record-keeping accuracy. The risk of default increases after a company adopts blockchain technology.