Rich families and family offices across Asia increase their cryptocurrency allowances, some planned to allocate around 5% of their portfolios to the asset class. Reuters first pointed out the trend, which noted a wave of demand for high -value people in Singapore, Hong Kong and continental China.

Heritage managers have told Reuters that they received more requests for customer information, while cryptocurrency scholarships have declared an increase in negotiation volumes and new cryptography funds are making a strong demand.

Jason Huang, founder of NextGen Digital Venture, said that his company had collected more than $ 100 million in a few months for a new short -term crypto action fund launched in Singapore in May. Its previous fund, which was down last year, returned 375% in less than two years.

UBS, the Swiss Investment Bank, noted that some foreign Chinese family offices are behind the quarter work, pointing to cryptographic allowances of around 5%. The bank said that members of the second and third generation of family offices are starting to find out and participate in digital assets.

Cryptocurrency exchanges in the region also reported more activity. The hashkey Exchange of Hong Kong said that its number of registered users increased by 85% in annual shift by August 2025, while cryptocurrency data showed negotiation volumes in the three major exchanges of South Korea have increased by 17% so far, with average daily volumes climbing more than 20%.

The Asian crypto boom has been directed to detail so far

Until now, the Boom of Asia’s cryptography has been driven from bottom to top. Chain-analysis data show that the region of Central and South and South and Oceania (CSAO) has experienced more than $ 750 billion in entries between mid-2013 and mid-2024, or around 16.6% of world volume. The entries were supplied mainly by retail users carrying out transactions less than $ 10,000 for exchanges, funding and decentralized finances (DEFI).

In the World Cryptography of Chainalysis’ worldwide adoption index, India ranked first in the world, retail investors leading an activity on centralized exchanges. Indonesia ranked third, driven by the base participation and a fast -growing web3 sector.

Vietnam ranked fifth, with an adoption distributed on the centralized platforms and the DEFI. And the Philippines arrived in eighth, where the crypto is widely used for funding of funds and game games.

Singapore has also become a hub for cryptographic payments. Chain-analysis data has shown that market services in the country have treated almost a billion dollars in cryptocurrency in the second quarter of 2024, with stablecoin transfers widely used for retail transactions.

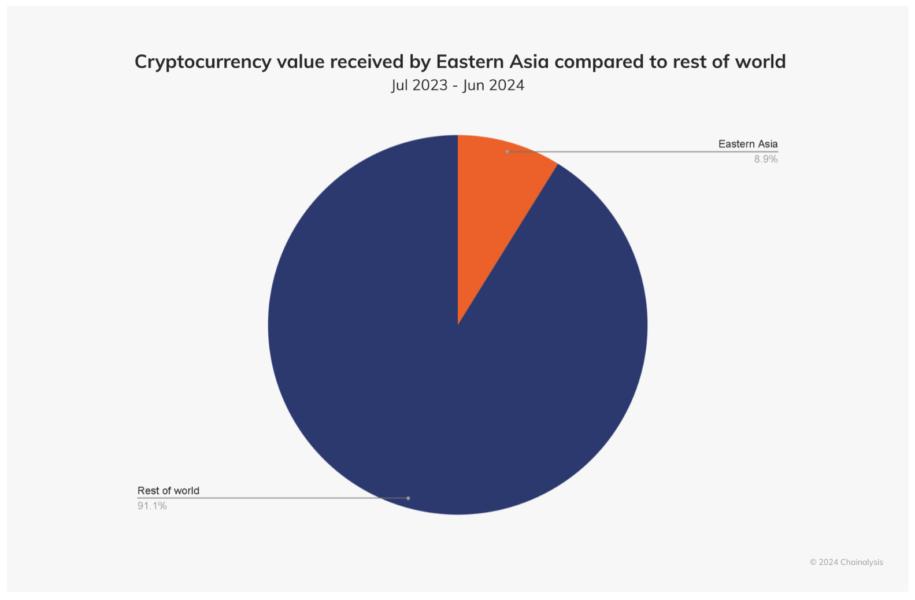

But East Asia has told another story. The region added nearly $ 400 billion during the same period, with activities more shaped by professional and institutional investors, and in some cases, by rich citizens using crypto as a value reserve.

South Korea has received around $ 130 billion in crypto, making it the largest market in the region. Professional merchants have led a large part of this activity through altcoins and stablescoins, and with arbitration strategies linked to “Premium Kimchi”.

Hong Kong posted the fastest growth in the region, with an activity up 85.6% in annual shift. More than 40% of the entries came from stablescoins, while the approval of three bitcoin points (BTC) and three ether (ETH) exchanged funds (ETF) in April 2024 stimulated institutional flows and a change to direct BTC and ETH farms.

In China, the activity has moved to the OTC and P2P platforms after the 2021 repression of exchanges. Rich citizens have used the crypto more and more to preserve assets and move money abroad, flows increasing at the end of 2023, the real estate market is weakening and the stock market indices fell.

Asia also represents 32% of active cryptography developers, according to the 2024 electrical capital developer report. This is up only 12% in 2015, with 41% of new crypto developers from the region.

Asia Express: “ China’s microstrategy ‘Meitu sells all its bitcoins and Ethereum