Here is a quick summary of the cryptography landscape for Wednesday July 2 from 9:00 p.m. UTC.

Get the latest information about Bitcoin, Ethereum and Altcoins, as well as an overview of the new key cryptocurrency market.

Bitcoin and Ethereum Price update

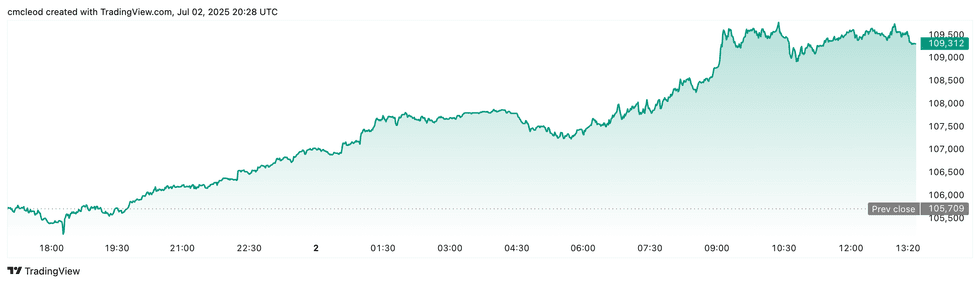

Bitcoin (BTC) is at the price of US $ 109,452, up four percent in the last 24 hours and its highest day assessment. The day range for cryptocurrency reported a hollow of US $ 107,542.

Bitcoin Performance Price, July 2, 2025.

Graphic via Tradingview.

Bitcoin price gain was driven by an overview of tensions in the Middle East and growing optimism after the American federal reserve reported a dominant inclination; both factors Stimulated the appetite for the risks of investors. In addition, continuous entrances to the United States are taking place in Bitcoin Bitcoin (ETF) Bitcoin Funds and favorable regulation expectations have contributed to supporting momentum.

Ethereum (ETH) is at the price of US $ 2,584.30, up 7.5% in the last 24 hours and its highest of the day. Its lowest evaluation Wednesday was 2,446.41 US $.

The news of today’s crypto namely

The judge authorizes the trial of $ 1 billion against Tether

An American bankruptcy judge is authorize a legal action of $ 40 billion Against the transmitter of the stable transmitter, Tether to proceed, according to court documents deposited in New York on Monday, June 30. THE The trial was launched By the lender Crypto Celsius, who accused Tether of liquidating hardly nearly 40,000 bitcoins of his platform in June 2022.

Attached tried to reject complaintsarguing that the liquidation had to cover the debt with $ 812 million in Celsius when Bitcoin prices dropped. Tether also said that the US courts had no authority over the non -American operations of Tether, a complaint with which the judge disagreed and argued that Celsius had led the liquidation.

Coinbase buys liquifi in an unknown agreement

Coinbase A Acquired liquifA startup that builds tokens management platforms for crypto projects, continuing its sequence of mergers and acquisitions charged in 2025. Liquifi, supported in its seeds in 2022 by Dragonfly and investors like Balaji Srinivasan, helps projects to follow the acquisition in tokens, to manage the tables of cryptographic cap and to manage tax needs. Coinbase refused to disclose the purchase price, but said that Liquifi will help rationalize the launches and the distribution of tokens. This puts Coinbase closer to a “end -to -end” model, similar to Launchpad de Binance, which supports the creation of crypto from the first stages.

Liquifi was locked in a legal fight with the competitor Toku on an alleged commercial document theft, complaints she denies, and Coinbase said she would remain in the defense of Liquifi.

The agreement follows other Coinbase acquisitions this year, notably Spindl, the Iron Fish team and the company record $ 2.9 billion drunken by 2.9 billion dollars.

The dry considers the rationalization lists of ETF

The American Commission for Securities and the Exchange would have considered a modification of its registration structure which would allow the ETF issuers to submit an S-1 form, the initial registration registration file, without having to file a form 19B-4 first.

It is according to Cryptographic journalist Eleanor TerrettWho added that he was told that the issuers would not need to wait 75 days before registering their tokens if they met the criteria of a general registration standard, the details of which are still unknown but could involve criteria such as market capitalization, liquidity and trading volume.

The billionaires of technology launch a bank focused on the crypto

A group of eminent technological investors, including Palmer Luckey d’Andundil, the founding fund of Peter Thiel and the co-founder of Palantir Joe Lonsdale, support a new crypto bank based in the United States called Erebor, According to the Financial Times.

Erebor asked for a national banking charter and plans to serve technology -oriented sectors such as artificial intelligence, defense and crypto, as well as individuals working in these fields.

The digital bank only will have its headquarters in Columbus, Ohio, with an additional office in New York.

Erebor intends to maintain stablescoins on its balance sheet, offering a stable value supported by the reserves. The bank is led by Owen Rapaport and Jacob Hirshman, a former circle counselor.

Erebor’s mission is to fill the gap left by the Silicon Valley Bank collapsewhich had been a critical channel for startups and venture capitalists until its 2023 failure.

Allunity to launch Euro Stablecoin

The Bafin financial guard dog, Bafin, granted regulatory granted In Deutsche Bank and his asset management arm, DWS, for their joint venture, alluance. They will launch a stablecoin euro called Eurau, set 1: 1 at the euro.

Approval allows allity to launch its stablecoin in accordance with new Mica regulations. Stablecoin aims to facilitate secure digital payments, transparent and in accordance with institutions and businesses across Europe.

In other news from Europe, the European Central Bank said it was planning to test a new system Use blockchain technology by the end of 2026 to pay the payments in euros. This initiative, called Pontes, is part of a two -track approach that will connect modern blockchain platforms to existing payment systems in the euro zone.

China considers stablecoins to strengthen the cross -border payment strategy

Political advisers in China pressure Bloomberg reported.

The Governor of Banque Populaire de China (PBOC), Pan Gongsheng, noted that stablecoins could make international finances more resilient with geopolitical disturbances, a view postponed by other senior officials.

The former PBOC governor Zhou Xiaochuan suggested that the stables -coats linked to a dollar could even speed up dollarization, while others see a case for parts supported by the Yuan to support China’s long -term monetary objectives.

The momentum occurs after the American Senate adopted a bill on stables in JuneAdvance the digital currency program of President Donald Trump. The supply of Stablecoin should reach 3.7 billions of US dollars by 2030, driven by cheaper and faster payment options compared to traditional banking services.

Disclosure of securities: I, Giann Liguid, does not dispute any interest in direct investment in any company mentioned in this article.

Disclosure of securities: I, Meagen Seatt, does not challenge any interest in direct investment in a company mentioned in this article.