In the second quarter, the proportion of users using cryptocurrencies as a coverage against inflation increased from 29% to 46%, according to data shared with Forklog by the exchange of Mexc cryptocurrency.

Macroeconomic instability, weakening national currencies and inflationary pressures encourage people around the world to seek alternative means of preserving value. Cryptocurrencies are becoming more and more such a solution, have noted experts.

The most significant increase was recorded in East Asia, where this figure increased from 23% to 52%. In the Middle East, it almost doubled, from 27% to 45%.

Behavioral differences

The study also revealed strong regional differences in the motivation and behavior of cryptographic investors. Latin America has become a hub for “community acceptance”, the analysts said. There, the number of coins has increased to 34% – the highest in the world.

Almost 63% of new users in the region invest in digital assets to win a passive income. The market remains focused on retail investors motivated by the search for return and community activity.

Meanwhile, South Asia has confirmed its “global commercial power” status. Trading volumes to the point in the region increased from 45% to 52%, exceeding the global average. More than half of cryptographic investors said that their main objective was to achieve financial independence.

“Given the young mobile population and limited access to traditional finances, the region becomes the most dynamic retail market. South Asia also leads other regions of long -term commerce (46%), while Europe shows a more moderate adoption, remaining closer to global averages, “said the study.

Distribution of capital

Public blockchains tokens remain the foundation of cryptographic portfolios worldwide, owned by more than 65% of users. The greatest confidence in this category of assets is observed in Latin America (74%) and Southeast Asia (70%).

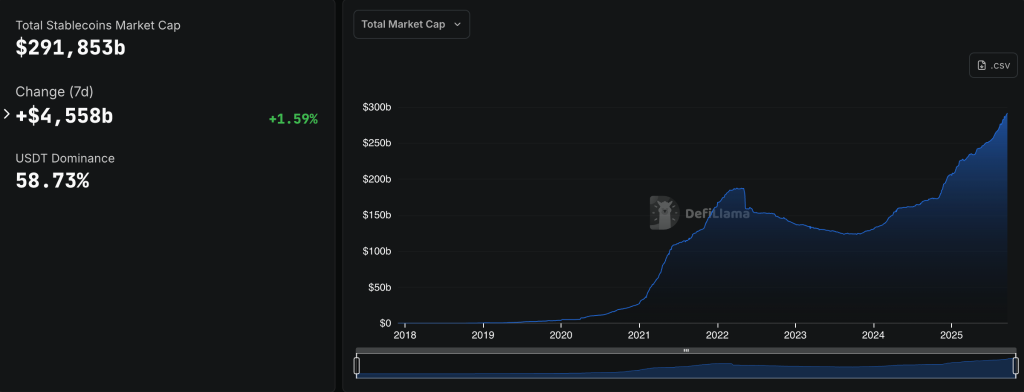

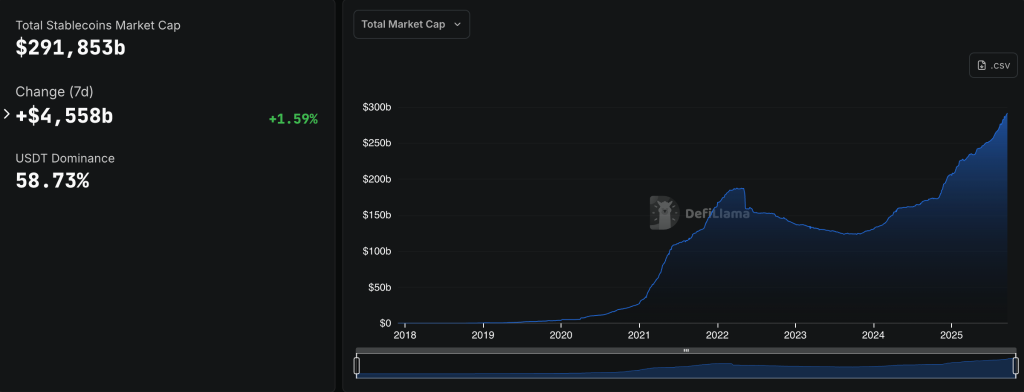

The share of stablecoins remained stable – more than 50%.

Analysts also highlighted the changes in the distribution of capital. In East Asia, the share of large portfolios (more than $ 20,000) increased from 39% to 33% due to profit and regulatory constraints.

Intermediate level addresses ($ 5,000 to $ 20,000) have become more common, indicating “a more uniform distribution of funds and the role of strengthening digital assets as an accessible financial tool”.

“The adoption of cryptocurrencies evolves differently worldwide, and there is no unique approach. From the inflation of the East Asia coverage to community growth in Latin America, these regional characteristics highlight the importance of localized solutions, “noted Mexc Coo Tracy Jin.

Experts predicted the pursuit of the trend in using cryptocurrencies as a means of preserving value. They also anticipate a passage from speculation to a more structured exchange, to a more active portfolio diversification and additional polarization by capital levels.

As indicated in the global cryptocurrency adoption index for 2025 by the Chainalysis analysis company, Ukraine and Russia have been classified as eighth and tenth respectively.

Нашли шибку В тексте? Выtern

Рассылки forklog: держите ра Пльсе биткоин -индустрии!