Portfolio security is a major problem for cryptographic wallets. In 2024, private keys compromise represented most of the stolen crypto, according to a Chain report. The amount of stolen funds increased to $ 2.2 billion, and the number of individual hacking incidents increased from 282 in 2023 to 303 in 2024.

Multi-signating portfolios explained

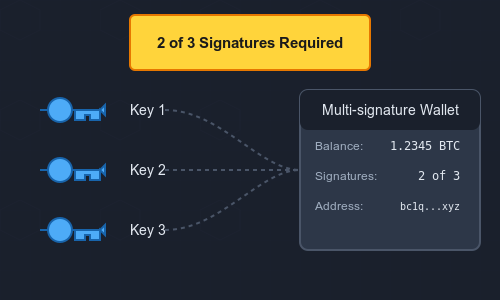

A multi-signature portfolio is a cryptographic portfolio that requires several private keys to unlock as a way to improve security. For examples, a multi-signature portfolio of two out of three would require a pass key of two of the three co-signers on the wallet. This reduces the potential from a single failure to cause a cryptographic wallet violation.

This report shows the endless increase of cryptographic hacks, which is an important problem in Blockchain security.

Multi-signating portfolios have been introduced to solve this problem. These portfolios make cyber attacks on cryptographic wallets More difficult by increasing the number of potential failures that hackers meet throughout the process. They are from 2012 and were implemented in 2013. The first blockchain to incorporate them was Bitcoin.

What are multi-signating portfolios?

A multi-signature portfolio works like a banking safe, requiring several private keys to unlock. Users can define the number of keys and the minimum required to carry out actions. These portfolios use a signature technique called M de N, where M is the minimum number of necessary signatures and is the total number of keys necessary to sign the transaction.

For improved safety, each user who has a private key also receives a unique recovery sentence. This adds an additional layer of security to your assets, which makes a single failure more difficult, such as losing a private key or being a victim of a phishing attack.

For example, a multi-signature portfolio of two out of three requires at least two signatures of a total of three private cosignates or keys to send a transaction from a portfolio. The public address of the portfolio will be derived from the three private keys.

Multi-signature portfolios can be configured with various M of N configurations, such as three of the five, four of the six, or even more complex. The choice depends on your specific safety requirements and the desired access control level.

Advantages of multi-signating wallets

1. Increase in safety against cyber attacks

Cyber attacks On cryptographic wallets are common. Multi-signating portfolios add an additional safety layer against these attacks. Even if a pirate manages to compromise a key, he will not be able to move funds without access to the other keys required. This increases the difficulty of pirates and makes multi-signating wallets a much less attractive target.

2. Protection against unique failure points

Multi-signating portfolios eliminate the unique failure point associated with a single private key because they require several keys to authorize a transaction. Losing one of the keys does not give access to your assets. In addition, they eliminate dependence on a single device. For example, one of the private keys can be recorded on a smartphone, while another can be stored on a desk or laptop.

3. Attenuation of theft or loss of private key

If a key is compromised, it does not mean that everything is lost. The other keys are still there to protect your assets, and you can often restore access. However, cybercriminals are developing new methods to hack portfolios.

4. Improved control of fund management

This is beneficial for commercial operations to prevent the abusive use of funds. Multi-signating portfolios strengthen control of fund management, as two or three people must authorize transactions, not only one.

For example, with a multi-signature configuration, a single stakeholder cannot simply perform a large transaction without the agreement of the other stakeholders in an organization. This adds an additional layer of fund guarantee and makes much more difficult for someone to act alone, because everyone must sign a transaction, thus strengthening responsibility.

5. Reduction of initiates threats

If an employee or a partner who has a key decides to act maliciously, he cannot unilaterally steal funds. Other keys will have to be part of the transaction to move any active. This level of responsibility and shared responsibility makes it much more difficult to move assets, and it is a huge victory for security.

Multi-Signating Portfolios applications

Cryptocurrency exchanges

For Cryptography exchangesSecurity is crucial. They have massive amounts of user assets, making huge targets for pirates. Multi-signating portfolios are an essential tool in their safety arsenal. By obliging several signatures to move assets, exchanges reduce the risk of inner flight or a single point of failure exploited.

Exchanges also use several signatures in their cold storage strategies. Cold storage means storing the offline crypto, far from Internet connections, to protect it from online attacks. Multi-signating configurations allow them to safely manage these offline chests, distributing a key control among several goalkeepers, further improving asset safety.

Commercial operations

Companies, especially those dealing with crypto, often have teams that manage their finances. Multi-Sigs portfolios are ideal in this case. They allow several authorized people to access and control the assets in company cryptography, which obliges the agreement of several people to deal with transactions. This prevents only one thug employee from making unauthorized movements and allows greater responsibility.

Large companies or Decentralized autonomous organizations (DAO) Need for sure means of managing their cryptographic treasury bills. Multi-signating portfolios can guarantee that no one has the power to move the funds of the company or DAO. This creates a control and counterweight system, increasing safety and reducing the risk of loss, accidental or intentional.

Individual users

Multi-signature is not intended only for institutions. It is also beneficial for individual users. The distribution of private keys between several parts or peripherals provides a robust backup solution for your wallets. Using multi-signage configurations, people can protect themselves from the loss of their funds due to a lost key, a flight or other unhappy events. If a key is compromised, the others still hold their authority.

Multi-signating portfolios also offer innovative solutions for heritage. Families can set up portfolios that require several signatures to move funds, which can be distributed between several family members. This can help manage the inheritance processes in a safer and transparent way while ensuring that funds are treated in a responsible manner in the event of an emergency. It guarantees that assets can be transmitted according to the owner’s desire and reduces the risk of legal complications.

3 examples of multi-signating portfolios

1. Cashmere

Cashmere is a multi-signature portfolio built on Solana. The portfolio easily allows fund management within organizations. It supports the ground tokens and all the Solana (SPL) programs library and can be integrated into all Solana portfolios.

2. MPCVAULTS

Mpcvault is a non -guardian portfolio for teams and web companies. These are several chains, multi-sig and multi-active.

3. Ownbit

Own is a cold and multisig wallet for Bitcoin, Ethereum, Tron and more. It uses two mobile phones to implement cold wallet functions. Users do not need to buy additional equipment. It has an integrated cold wallet function which makes it as secure as material portfolios.

Challenges in the use of multi-signating wallets

Although multi-signating portfolios offer a robust security approach, it is not without problems.

1. Speed

Multi-signating portfolios aim for higher security, but this is often done at the expense of convenience. The need for multiple signatures means that transactions take longer to treat. They require a more complex workflow for each transaction, and this can be a real problem even if one of the required signatories is not available.

2. No legal aid

When several private keys are involved, there is no legal guardian of the funds deposited in such a portfolio, which is in fact shared with several owners of private keys. In case there is a problem, it is difficult to obtain legal aid.

3. Recovery

The process of recovering a multi-signature portfolio is complicated because it will be done by important recovery sentences on different devices.

4. Complexity in configuration and use

The configuration process can be demanding, forcing several participants to coordinate, generate keys and configure the portfolio. It is not as easy as creating a regular or unique portfolio; You must understand the concept of shared control and the different signature thresholds.

5. Human error potential

With several participants and more demanding processes, there is an increased risk of human error. Someone could mislead their private key, forget the signature order or involuntarily sign a malicious transaction. These errors can lock the funds in the wallet, sometimes permanently.

Multi-signating portfolios are important for blockchain safety because they offer many advantages to individuals, businesses and blockchain entities.

Despite the challenges associated with multi-signating portfolios, they are even safer for commercial operations and reducing the hacks of wallets. They improve security, guarantee unanimous decision -making and make the management of cryptography more credible.